Money Coaching - Even For People Who Hate Talking About Money

I’m pretty certain everyone has issues around money. The issues are, of course, different depending on what’s in your bank account and your history, but there are issues all the same. Personally, I’ve wrestled with money because I grew up with very little and have seen how trapped women can get when they don’t make their own money. But I’m also totally weird. Though I feel very strongly about women making their own money, I have found myself running away from fiscal knowledge and assuming a very traditional role in our household where I’m largely clueless about finances. It took a lot of prodding by Jon to get me to not be clueless about my business finances, and when I did finally take that step, it was incredibly empowering. But I still chose to remain clueless about household finances.

So when Capital One reached out to ask if I’d like to explore their one-on-one money coaching program, I was both hesitant and intrigued. On the one hand, I was hesitant because I clearly have money baggage. On the other hand, I was intrigued because I would like to be more empowered and less clueless. Also, after exploring the website, I knew I wouldn’t need to bring any records, which was reassuring since I have no idea where they are!

And you guys, the experience was totally, utterly fascinating. Life changing even. First, Harvard Square was my backyard growing up, so going to the Harvard Square location (which is roughly in the spot where Pizzeria Uno used to be) was rather nostalgic. Second, the Capital One Café is 100% not a traditional bank. The location is a cool local hangout – in addition to the coaching rooms, there are lots of people just hanging out drinking coffee at the café. Third, the woman who led my coaching session was cool. Bank people tend to intimidate me; however, my coach was a designer and life coach, which made me immediately feel less anxious and more comfortable. Beyond those initial trappings, though, here’s what I learned through the coaching session:

1. Talking about money doesn’t always mean talking about money

My two first thoughts were, “Yay I don’t need to talk specifics about assets and debts!” but also, “Well then what the heck are we going to talk about?” Part of Capital One’s effort to change the conversation about money is to offer an approach that is distinctly not financial advising. Instead, the one-on-one sessions focus on your individual values, priorities, dreams, and potential roadblocks, which I am totally into. It was kind of amazing how useful the session was, despite the fact that we didn’t talk about dollar values, and instead spoke in terms of general financial buckets (e.g., mortgage, student loans).

2. The 90-minute coaching session doesn’t involve paper records

As I mentioned, NO RECORDS REQUIRED. Here’s the flow of the session:

- The session starts with a short online survey.

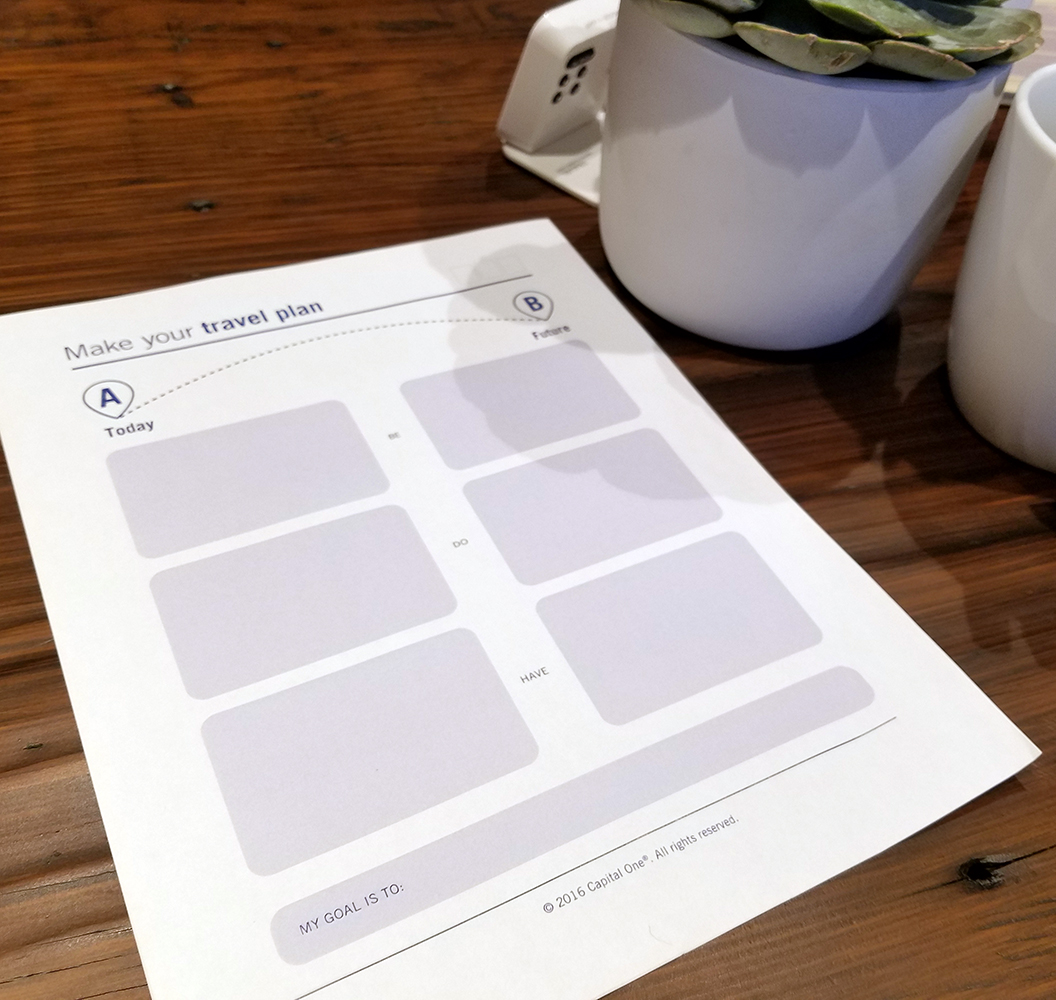

- You then talk with your coach about your “travel plan,” which involves thinking through: 1) who are you today and who do you want to be in the future, 2) what you do now and what you want to do in the future, and 3) what do you have now and what do you want to have in the future.

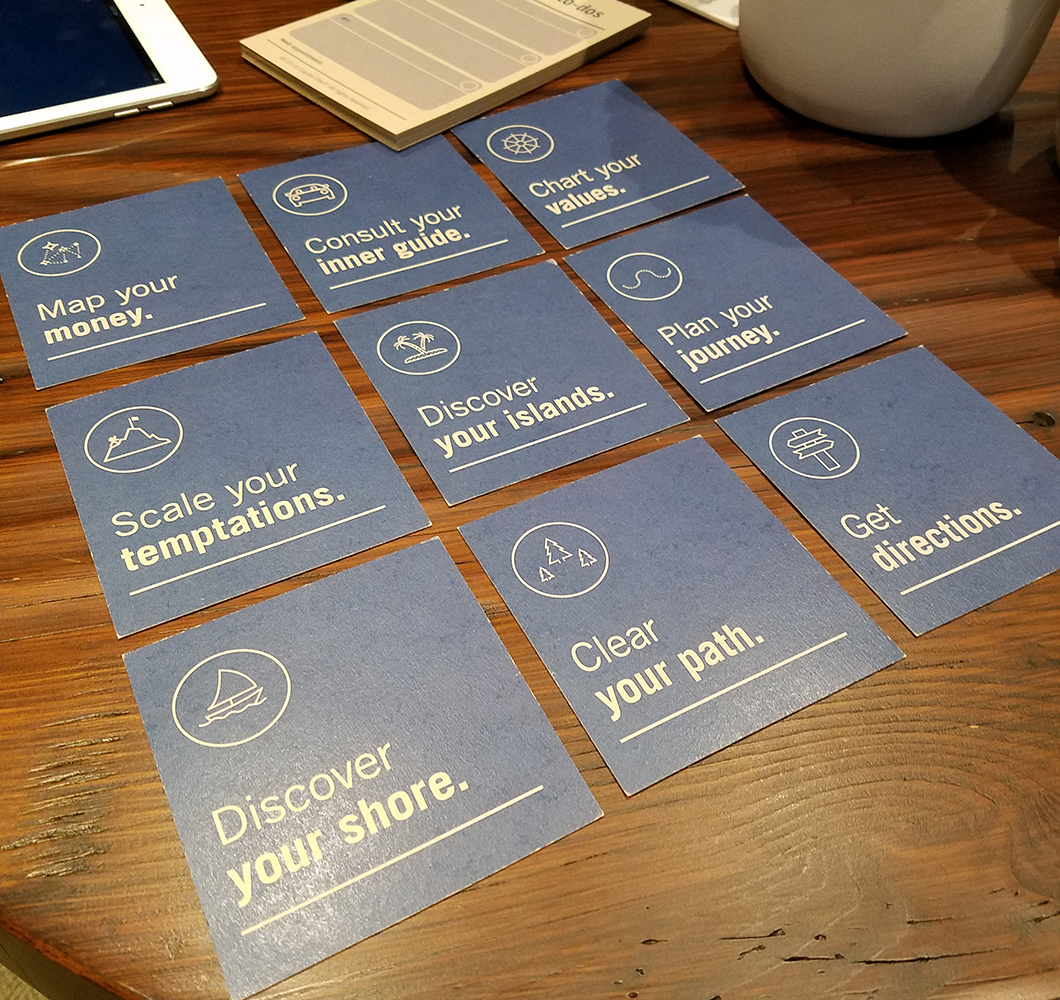

- Based on the travel plan, the coach identifies a couple of key tools (from a collection of 9) that you might want to work on and then you choose one thing to tackle. I chose the “Map Your Money” option and we worked through a process that helped me identify assets, debts, personal experience (that could contribute to my earning or life goals), the relationships that impact my life goals, and general goals and obstacles.

- Based on the travel plan and tool process, you then identify 2-3 concrete to-dos to take forward.

- The session concludes with a short exit survey.

3. My logic is weird

I self-reflect a lot (plus, I’m married to a therapist). However, it wasn’t until this session that I realized some very strange logic that has lodged a wedge between me and our household financial records. I apparently have a very deep, bizarre fear that Jon will be hit by a meteor or eaten by a bear (he enjoys camping so the latter is not totally out of the question). As a result, I have developed an avoidance strategy where I have rationalized that if I remain clueless about finances, then he won’t get hit by a meteor or eaten by a bear. That somehow, if I prove to the universe that I know where everything is, then the universe will take Jon away from me. I know this sounds crazy, but this has apparently been my reality.

4. I can be my biggest obstacle

I am really good at moving things forward. I mean you guys, I launched a t-shirt business within a month of figuring out how to make t-shirts. But related to #3, this coaching session helped me realize that I can also be my biggest obstacle. The good news is that also means I can make change happen once I identify how to get around an obstacle.

5. It’s possible to have financial to-dos that aren’t overwhelming

During the session I identified that my goal was ultimately to get a broad strokes summary of our financial picture so I could: 1) be less clueless in general, 2) be less anxious about money, and 3) perhaps be less hard-driving and more present in everyday life, since I’m not carrying anxiety or wondering if I need to take on more projects to pay the bills. I came away with to-do items of: 1) putting a date on the calendar for a financial check in with Jon, 2) actually having the meeting with Jon, and 3) adding an end of day transition window to my calendar so I can be more present when it’s time to jump into family mode. All of these things are totally doable.

6. A 90-minute session apparently can change your life

And you know what? The very next day I asked Jon if we could have a meeting. I explained my weird logic and fear of abandonment. I apologized for fighting so hard against his efforts to help me be knowledgeable about our household finances. I told him I just wanted broad strokes not deep details. And then in about 10-15 minutes he outlined our assets and debts and where all those records live. I took notes. And all of a sudden I felt a whoosh of relief. And instead of fear, I felt excitement about our future together -- a future that is decidedly free of meteors and bears.

In a nutshell, I recommend you check out Capital One’s money coaching program if you feel even vaguely stuck about financial issues. You guys, it is FREE so go on and schedule a session in the Harvard Square Café! This coaching program is part of Capital One’s ongoing efforts to reimagine banking here in Boston. If you’re not in the market for one-on-one coaching at the moment, I’d still encourage you to check out one of the Capital One Cafés in Boston – they currently have 5 locations with three more opening in the coming months in Hingham, Lynnfield, and the Seaport. Hooray for becoming more knowledgeable and less anxious about money!

Disclosure: This post reflects a compensated editorial partnership with Capital One. All thoughts about money, feminism, and meteors are -- of course -- my own.