How to Teach Kids Financial Literacy

One thing that has always seemed crazy to me is that financial literacy is not part of school curriculum. Through high school and college I learned about money through scarcity (I was on my own financially after freshman year in college) and via the post-sign-up panic related to signing up for student loans and credit cards with very little understanding of what my signature meant.

I have always felt that there needs to be a better way, and since having kids I have definitely felt like the onus is on parents. But I recently learned about something super awesome: MassMutual’s FutureSmart program. FutureSmart is basically the thing I have been asking for! It’s a nationwide initiative that brings financial education to middle and high school students across the United States. Through their digital course and mobile app, and also through live events with local NBA basketball teams and actor and author Hill Harper, FutureSmart is working to bring financial education to over 2 million students and their families by 2020. To learn more about the program, its impact, and how to bring FutureSmart to your school, visit futuresmart.massmutual.com.

Hill Harper’s Real Talk About Money

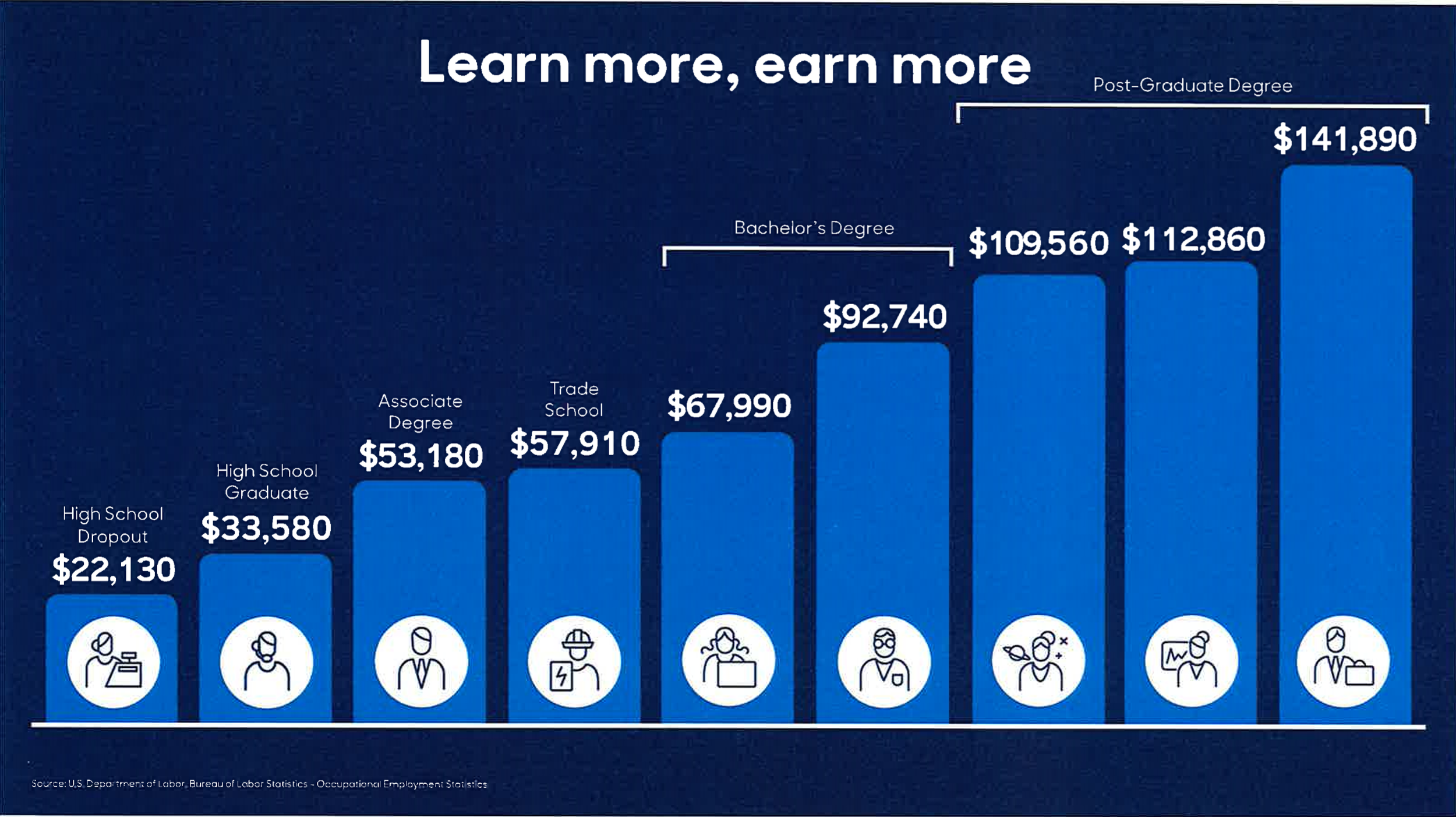

I unfortunately wasn’t able to make it to Hill Harper’s recent Boston event but I love that among the many things he tackles in his presentations is real data (yay, data!). There were two main points that jumped out at me. First, he talks about the relationship between education and earning; basically, the more you learn, the more you earn (with the endpoints being a salary of $22,130 for someone who doesn’t complete high school and $141,890 for someone with a post-graduate degree).

Learn more, earn more. Source: U.S. Department of Labor Bureau of Labor Statistics - Occupational Employment Statistics (via Hill Harper)

And second, traditional living includes predictable expenses (housing, food, transportation, etc.) and that one crucial way to be smart about money is to eliminate debt repayment (read: among other things, don’t go nuts with credit card spending and get mired in unnecessary credit card interest fees) and move that money to savings.

Typical expenses. Source: Home Budget Cost-of-Living Reality Check, Intuit Quicken 201 (via Hill Harper)

Ideal expenses. Source: Home Budget Cost-of-Living Reality Check, Intuit Quicken 201 (via Hill Harper)

Now, while I definitely recommend checking out FutureSmart and their digital course and mobile app, I also wanted to share my top tips for how to teach kids financial literacy.

6 Ways To Teach Kids Financial Literacy

1. Give kids allowance (and truly let them experiment with it!)

One question I get asked about a lot is allowance. Whether you want to give a regular allowance and how much it is will vary for different families but I do think giving kids an allowance (weekly or monthly) is important. Kids need to understand the value of currency and they won’t be able to do that without being able to experiment with actual currency.

2. Talk to kids about different ways to use money

The three basic things to convey to kids about using money are: spending, saving, and sharing (through charitable contributions). All three things are important and can be discussed when you give kids allowance or if they receive a cash gift at their birthday.

3. Open a bank account

Part of teaching kids to save money includes putting that money somewhere! Last year I took Vi (and the envelope full of cash she had been collecting over the years) to the local bank to open a bank account. It was really sweet and I also took the opportunity to teach her the old fashioned life skill of shaking someone’s hand after you finish a business transaction. (She thought that part was awkward.)

Simple ways to teach kids financial literacy

4. Be OK with low-impact spending mistakes

As with anything in life, mistakes happen and can be valuable learning opportunities. And when it comes to money, better to have those mistakes happen in a low-impact (small dollar) situation. For example, if your kid wants to spend some of their money on a (ridiculous or flimsy seeming to you) toy, it’s OK to give them a gentle warning if you think it feels overpriced or really flimsy, but then if they decide they still want to go for it, let them go for it. And while it may prove to be the best purchase ever, if it turns out to be a dud, that will be a lesson learned for them.

5. Help facilitate earning opportunities

Last year (after Laurel finished 8th grade) was a real pivotal moment for us because Laurel officially crossed into the world of earning money versus us paying for camp! She had a regular babysitting job and also had a couple of baking gigs and it was pretty incredible in leveling up her financial literacy. Earning money completely changed how she looked at spending; price tags were no longer an abstract thing because she could calculate how many babysitting hours it took to pay for something. I needed to be involved in a lot of the logistics planning last year but this spring she is already thinking about her plan for the summer and will be increasingly independent pursuing babysitting clients.

6. Share financial stories—the good, bad, and the ugly

As you talk to your kids about money, share your stories. When I was a kid, money was such a stressful topic. My approach to storytelling is to be real but also infuse a little humor so that money isn’t a scary thing for my kids to think about.

To learn more about MassMutual’s FutureSmart program, its impact, and how to bring FutureSmart to your school, visit futuresmart.massmutual.com.

Disclosure: This article was sponsored by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001. www.massmutual.com All opinions are those of the author.